During the roundtable, participants were asked to take part in a poll to assess their opinions and sentiments towards a number of key parts of the discussion including regulatory change, talent management and technology. The results made fascinating reading.

Innovation around technology and regulatory change were the two main discussion points of the roundtable and their importance to participants also stood out in the poll conducted by EY at the event using Mentimeter.

Asked to rank the most important topics impacting the funds sector on Cayman, regulatory change featured most prominently, followed by innovation and technology, and talent. Other aspects of the industry including investment strategy, sustainability and economic substance legislation featured less prominently.

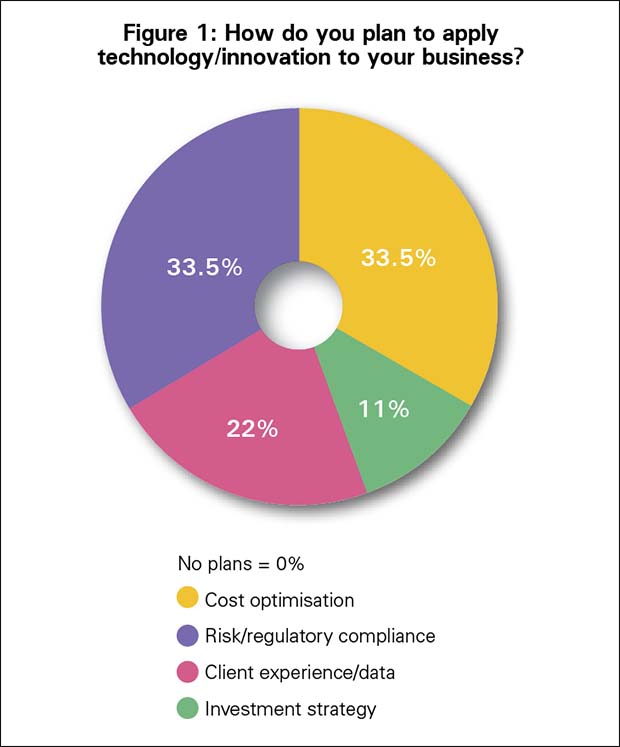

When asked how they apply technology and innovation to business, 33.5 percent of those in attendance said that cost optimisation would be the main focus, while another 33.5 percent said they would apply technology and innovation for risk and regulatory compliance (Figure 1).

Client experience and data were the focus for 22 percent of attendees, while 11 percent intended to apply technology and innovation for their investment strategy.

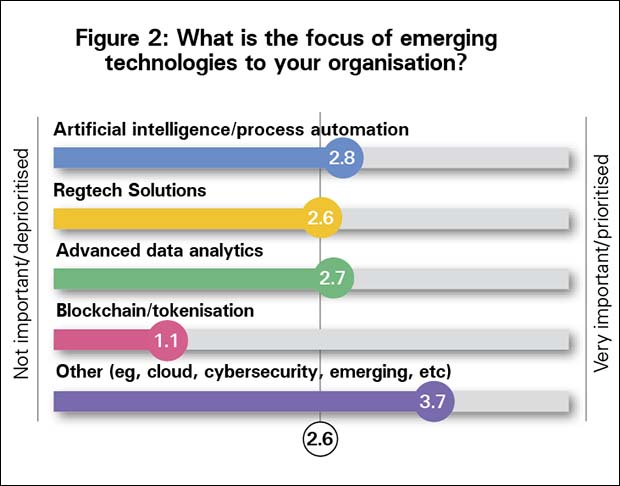

Artificial intelligence and process automation was highlighted as an application of emerging technologies within the industry, with blockchain and tokenisation ranked as not important or deprioritised (Figure 2). Advanced data analytics and regtech solutions were seen as having some importance.

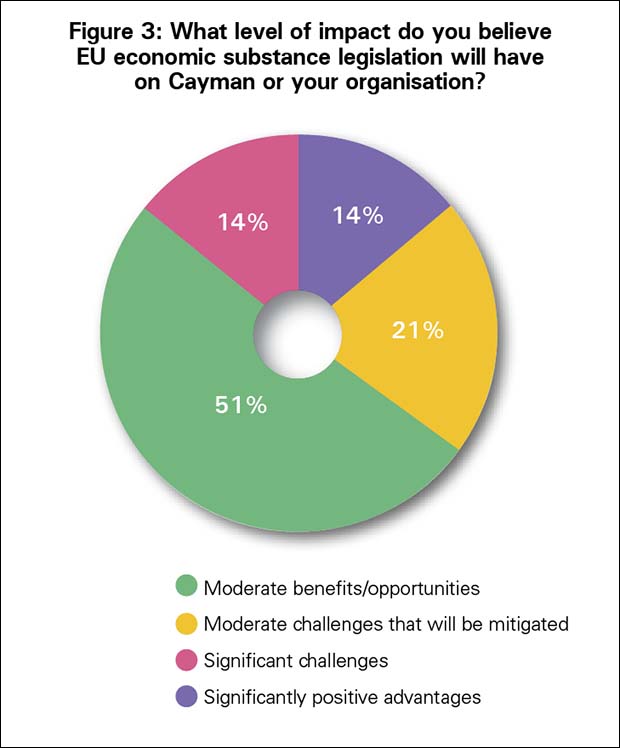

Asked what level of impact they believed EU economic substance legislation will have on Cayman or on their own organisations, 51 percent of attendees said it would provide moderate benefits and opportunities, with 21 percent saying it would cause moderate challenges that would be mitigated (Figure 3). Some 14 percent of respondents said it would cause significant challenges, but this was balanced by 14 percent who said it would bring significant positive advantages.

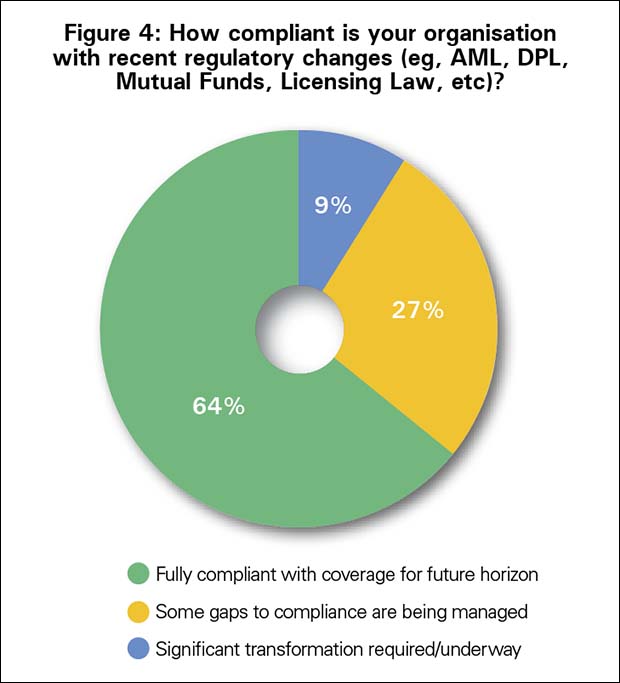

Asked how compliant their organisations were with recent regulatory changes, 64 percent of respondents said their organisation was fully compliant, while 27 percent said their organisation had some gaps to compliance, which were being managed (Figure 4). Some 9 percent said that significant transformation was required or underway.

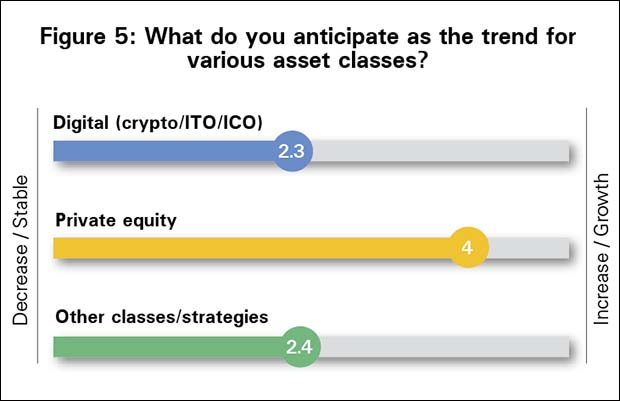

On the subject of future trends for various asset classes, private equity was highlighted as the class that would experience the most growth, with digital and other classes seen as stable (Figure 5).

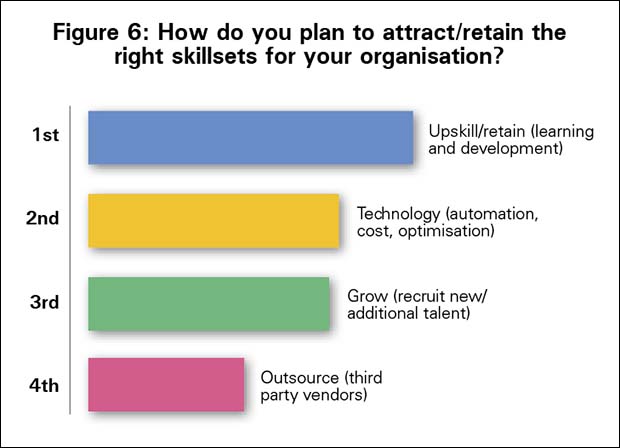

On the topic of how they plan to attract or retain the right skillsets for their organisations, respondents ranked upskilling and retention as the priority, followed by the use of technology for automation and optimisation (Figure 6). Growth through the recruitment of new and additional talent ranked third, followed by outsourcing.

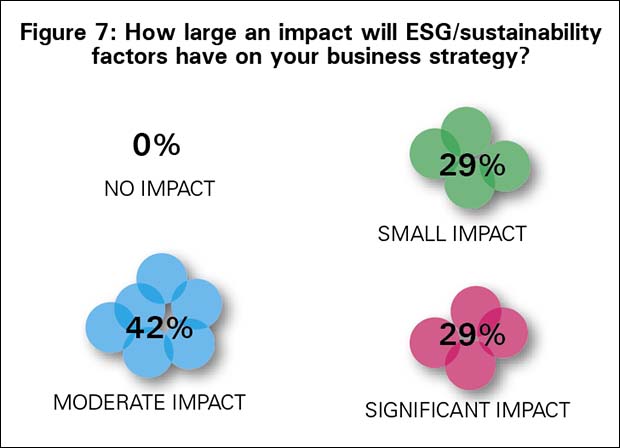

Asked how large an impact environment, social, and corporate governance (ESG) and sustainability factors would have on their organisations, 42 percent said they would have a moderate impact, while 29 percent said they would have a significant impact (Figure 7). Some 29 percent said the impact would be small.

The views reflected in this article are the views of the author and do not necessarily reflect the views of the global EY organisation or its member firms.

EY, Roundtable, Survey, Regulation, Technology, Cayman Islands