Shutterstock

Economic substance in the Cayman Islands: what does it mean, how do we address it and what does BEPS mean? Victor Murray of MG Management explores the implications of economic substance for funds in the Cayman Islands.

As concepts go, “economic substance” is not particularly descriptive nor helpful for a newcomer to this important aspect of international tax law. In short, subject to exceptions, economic substance (ES) dictates how certain offshore entities—based on their activities—must operate to maintain their favourable tax position.

The ES changes are driven by bodies such as the Organisation for Economic Cooperation and Development (OECD) and the EU, arising from their concern—rightly or wrongly held—about the possible erosion to the tax base in other jurisdictions. Here, I will explain some of the concepts and theories involved.

Alternative investment funds

Alternative investment funds formed in the Cayman Islands (not just those registered with the Cayman Islands Monetary Authority) are almost certainly exempt from the ambit of the International Tax Co-operation (Economic Substance) Law, 2018 (ES Law) which introduced ES requirements in the Cayman Islands.

BEPS

BEPS stands for base erosion and profit shifting. The OECD has stated that: “BEPS refers to tax planning strategies that exploit gaps and mismatches in tax rules to artificially shift profits to low or no-tax locations where there is little or no economic activity.”

It is with this backdrop that the Cayman Islands in consultation with the OECD and the EU introduced ES via the ES Law.

As every financial services industry professional is aware, the fact that the Cayman Islands has no direct taxation system does not equate to profit shifting. In fact, the attraction of the Cayman Islands is to allow tax neutrality so that the fund manager in a taxable jurisdiction X can accept investors from a taxable jurisdiction Y (with the fund manager paying taxes in X and the investor paying tax in Y).

It is for this reason that investment funds are excluded from the ES requirements.

SIBL-registered person: relevant activity

Entities conducting other activities are potentially subject to the ES law, eg, advising a fund registered in the Cayman Islands as a Securities Investment Business Law (SIBL)-registered person (formerly known as the SIBL excluded manager); in these cases the application of ES requirements needs to be considered.

Under the ES Law, a Cayman entity will need to have certain notification, reporting and substance requirements under the ES Law if it is (i) a relevant entity; and (ii) carrying out a relevant activity.

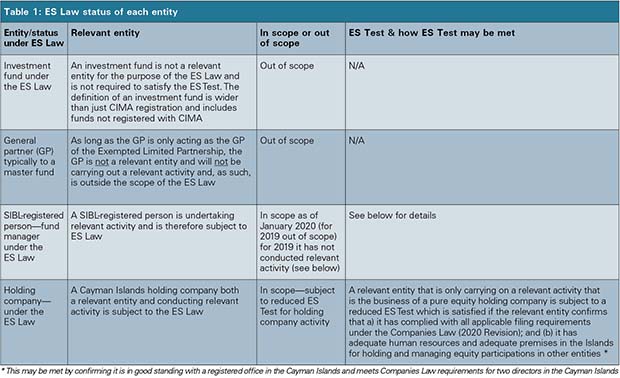

Applying the ES Law guidance to the most commonly used structures would typically result in the analysis shown in Table 1.

What it means to establish substance

In relation to the Cayman Islands manager who has also applied to become a CIMA SIBL-registered person it is in scope of the ES Law as at the date it becomes a SIBL-registered person.

The provision of discretionary investment management services is a relevant activity. As such, a SIBL-registered person will be a “relevant entity” and is carrying out a “relevant activity” and will have certain notification and reporting obligations. It will also need to have ES in the Cayman Islands.

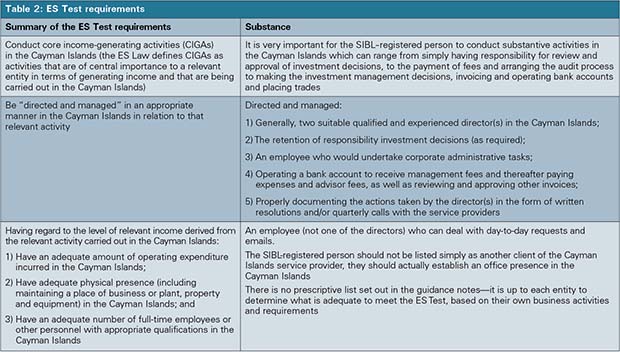

An exception is if the SIBL-registered person is tax-resident outside the Cayman Islands. Therefore, it is important to determine tax residence as the initial step before proceeding to apply the ES Test to the Cayman Islands entity (Table 2).

Summary

The ES requirements should certainly not be a deterrent to the use of a Cayman Islands entity for the efficient investment of investor funds and pooling of assets. In fact, it reinforces the established position that investors should be taxed in their home jurisdiction and not where the fund is based. The Cayman Islands offers the optimum solution for that activity.

Likewise, the activities covered by ES should be taken as an opportunity to demonstrate for entities in scope that real business activities are being conducted in the jurisdiction.

The Cayman Islands is a jurisdiction with the infrastructure to support those activities. This is a developing area and no doubt there will be refinements to this area following the experience of its implementation.

Victor Murray is a director at MG Management. He can be contacted at: victor.murray@mgcayman.com

Victor Murray, MG Management, Economic substance