Partnering with trusted and innovative service providers is essential for emerging managers to navigate increased regulatory demands, as Deloitte’s Serge Berube and Odette Samson explain.

Today’s hedge fund operating environment, transformed by the financial crisis, the collapse of Lehman Brothers and by financial frauds such as the Madoff scandal, has substantially increased the costs of meeting regulatory demands for hedge fund managers. The resulting regulatory and compliance costs have extensively raised the barriers to entry and have proved to be very real challenges for emerging managers.

Capital raising over the past five years has been extremely competitive—hedge fund consolidation has noticeably increased and a higher percentage of assets has been flowing to larger well-established managers. However, recent periods of underperformance by some larger managers have created new opportunities for emerging managers and recent studies indicate that there continues to be demand for emerging managers.

According to consultancy firm Preqin, institutional investors such as pensions, endowments, foundations and insurers account for more than 65 percent of capital invested in hedge funds, and more than 80 percent of the largest institutional investors have invested in emerging managers.

What is abundantly clear is that it is not enough to have strong proven performance, a skilled team and a compelling strategy. The growing institutional investor community’s focus on operational due diligence during the asset allocation process combined with the ever-shifting and intensifying regulatory landscape quite simply requires emerging managers to build out an institutionalised infrastructure to attract institutional capital.

It is widely known that new managers are held to the same standard as large managers when assessing back office and reporting capabilities, placing further pressure on a smaller manager’s resources. Without an institutional infrastructure that appeals to investors and regulators, capital growth will be restrained, regardless of fund performance.

Regulatory relief

While at least some relief from the demands placed on operations is provided by regulatory bodies for emerging and smaller managers, monitoring its AUM is critical in ensuring that it is prepared for the next layer of regulatory compliance.

Following are some of the more common regulatory regimes that can have a significant impact on a manager’s activities, which highlight the exemptions managers may utilise as they address their cost of compliance in the early years of operations. These and other regulatory, financial reporting and accounting updates are further explored in Deloitte’s Technical Briefs for Investment Funds: Vols 1 to 6.

Securities and Exchange Commission (SEC)—registered investment adviser

In general, the SEC requires most advisers to private investment funds with more than $150 million of gross AUM to register with the SEC. The SEC, however, provides some exemptions from registration to private fund advisers.

Small private adviser exemption

Private fund advisers with gross AUM between $100 million and $150 million may elect to exempt themselves from registration with the SEC. This small private fund adviser exemption applies only to advisers whose sole clients are private funds. If a fund adviser also has managed accounts or other non-fund clients, the $150 million small private fund adviser exemption wouldn’t apply (and a lower exemption amount for advisers in general of $100 million would apply).

Venture capital fund advisers

The SEC provides an elective exemption to advisers who act solely to one or more venture capital funds, as defined by the SEC.

Foreign private adviser exemption

A non-US adviser whose aggregate AUM attributable to clients and investors in the US in private funds of less than $25 million in AUM may be exempt from registration if it also (a) has no place of business in the US; and (b) has fewer than 15 clients and investors in the US in private funds advised by the adviser.

In general, advisers are not permitted to register with the SEC if AUM is less than $100 million, with registration intended to reside at the state level. There are some exceptions to this, including if the respective state doesn’t have a regulatory examination regime, and if state registration would cause the adviser to register in 15 or more states. In such circumstances, the fund adviser would be permitted to register with the SEC.

An SEC-registered adviser is subject to a host of ongoing regulatory and compliance requirements, and some emerging managers should expect to incur incremental costs in enhancing their infrastructure and formalising their processes and procedures in order to comply with these requirements.

Reporting requirements of certain exempt advisers (‘exempt reporting advisers’)

As discussed above, the SEC has provided specific (non-mandatory) exemptions from registration for certain private fund advisers with less than $150 million in AUM and to certain managers of venture capital funds. Advisers who would otherwise have to register with the SEC because of the general registration requirements, but are exempt from registration because they are relying on either the private fund adviser or venture capital adviser exemptions, are termed ‘exempt reporting advisers’ by the SEC.

Although exempt reporting advisers will not have to register with the SEC, they will still be required to file, and periodically update, reports with the SEC using the same Form ADV as registered advisers. Exempt reporting advisers, however, will only have to complete a subset of items on Form ADV including, among other matters, basic identifying information of the adviser, owners and affiliates, and information about the private funds that the adviser manages.

Alternative Investment Fund Managers Directive (AIFMD)

When assessing applicability of AIFMD to a manager’s operations, one of the first steps a manager should take is to determine its long-term strategy with regards to Europe. If the manager intends to market to European investors, then a plan must be established with the assistance of AIFMD experts.

Although the directive was introduced to harmonise regulation across the EU states, the transitional period demands expert knowledge of local laws in each country. Those countries that have approved the continuance of their national private placement regime (NPPR) until 2018 may do so under additional registration, reporting and transparency requirements.

On July 21, 2015, non-EU AIFMs will be eligible to seek full authorisation by applying for a ‘passport’ with the AIFM’s chosen EU member state of reference. The passport allows the AIFM to market its products throughout the EU while being authorised by, and reporting to, only one EU member state. At such time, the AIFM and alternative investment funds (AIFs) will be subject to the full regulatory and reporting requirements of AIFMD.

That being said, smaller AIFMs (‘sub-threshold AIFMs’) are eligible for certain relief under AIFMD. Sub-threshold AIFMs are defined as managers whose cumulative AIFs managed is either (a) below a threshold of €100 million, or (b) below a threshold of €500 million and include a five-year investor lock-up period.

A sub-threshold AIFM must register with its home member state, but it is not subject to full authorisation, and consequently has a lighter reporting regime, unless an individual member state where the fund is marketed adopts any stricter rules under the applicable national law.

Reporting by sub-threshold AIFMs

Information filed with its home member state is submitted annually and encompasses AIFM level reporting on principal markets and principal instruments in which it trades on behalf of the AIFs it manages, and its total AUM across all AIFs managed. Once the threshold is exceeded, annual reports must be filed, additional reporting is required on each AIF managed, and additional information must be provided to investors.

Monitoring AUM

According to the EU regulations, AUM should be monitored with the same frequency as the timing of investor subscriptions and redemptions. When a sub-threshold is exceeded, the relevant authority in the member state(s) must be notified immediately. If, within three months, the threshold remains exceeded, the AIFM would have to seek full authorisation with the country of reference and report the information within 30 days.

If, instead, the AUM fluctuated below the threshold again, the AIFM would be obligated to communicate the AUM at the end of the three months, but does not need to seek authorisation.

If the threshold is exceeded and the AIFM follows the NPPR, the AIFM must look to the NPPR in each member state in which it is seeking to attract investors to evaluate whether it meets the definition of ‘marketing’ in that particular state, and to determine its reporting requirements and filing deadlines in each member state.

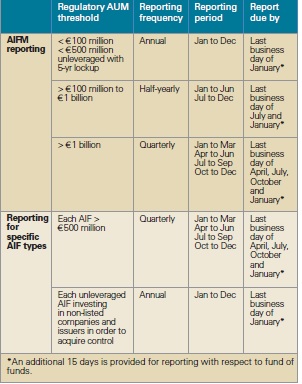

AIFMD regulatory reporting frequency and dates

Cayman Islands Monetary Authority (CIMA)

CIMA registration is required for a Cayman Islands fund unless it meets the exemptive criteria set out in Section 4(4) of the Cayman Islands Mutual Funds Law, which states that a Cayman Islands mutual fund is generally exempt from registration if it has fewer than 15 direct investors, the majority of whom are capable to appoint or remove the operator of the fund.

One exception to the ‘fewer–than-15-investors’ rule is in the case of a master fund. A master fund that holds investments and conducts trading activities, and has one or more regulated feeder funds (defined as a CIMA-regulated mutual fund that conducts more than 51 percent of its investing through another mutual fund) is required to register with CIMA.

Managers should be cautioned however that once the fund accepts more than 15 investors, the fund is required to register with CIMA immediately. When the strategy is to grow and attract new investors, the manager may decide to register the fund with CIMA at inception in order to be able to market a regulated product, a useful tool for emerging managers to give prospective investors further reassurance of oversight and demonstrate that they are well positioned for growth.

CIMA reporting

Funds registered with CIMA must file audited financial statements, issued by a locally approved auditor, within six months of its year end, in addition to a fund annual return.

"Collating a team of service providers with a global network of industry specialists is often crucial to understanding local laws, regulatory and tax regimes."

Positioned for growth

Most managers aim to attract international investors and invest globally, so collating a team of service providers with a global network of industry specialists is often crucial to understanding local laws, regulatory and tax regimes and their impact on the manager’s operations and the funds managed.

New and smaller managers are best positioned to gain the trust of prospective investors, and leverage their smaller operating teams, by aligning themselves with reputable partners having deep industry knowledge, including their onshore and offshore legal counsel, prime broker, independent auditor and tax experts.

Above all, leveraging service providers’ expertise and networks will help the new manager focus on the task at hand, managing the fund’s investment strategy and generating alpha. Deloitte has designed a platform focused on emerging managers and those that provide seed capital. To find out more contact the authors.

Serge Berube is a partner, Assurance & Advisory at Deloitte. He can be contacted at: sberube@deloitte.com

Odette Samson is a partner, Assurance & Advisory at Deloitte. She can be contacted at: osamson@deloitte.com

Regulation, Partnering, Serge Berube, Odette Samson, Deloitte, Preqin, AIFMD