The Cayman Islands International Tax Co-operation (Economic Substance) Law has implications for the fund management sector in Cayman, says Christian Victory of Appleby (Cayman).

The Cayman Islands is an early adopter of the Common Reporting Standard, compliant with the US Foreign Account Tax Compliance Act (FATCA), and a leading jurisdiction on tax transparency. Anti-money laundering and anti-terrorist financing legislative regimes aspire to the highest international standards, and the Cayman Islands’ commitment to compliance is unwavering.

The Cayman Islands government and financial services industry together have a long history of working closely and cooperatively with key intergovernmental organisations to ensure that the Cayman Islands regulatory framework remains sound.

One of these intergovernmental groups, the EU Code of Conduct Group, assessed the tax policies of a number of countries, including the Cayman Islands, in 2017. Following assessment by the Code of Conduct Group, the Cayman Islands was included in a list of jurisdictions required to address the Code of Conduct Group’s concerns regarding “economic substance”.

Like its counterparts in the British Virgin Islands, Bermuda, Guernsey, Jersey and the Isle of Man, the government of the Cayman Islands worked closely with the Code of Conduct Group to ensure that those concerns were adequately addressed. As a result of that engagement, a law to provide for an economic substance test, namely The International Tax Co-Operation (Economic Substance) Law, 2018 of the Cayman Islands (ES Law), and related Regulations came into force on January 1, 2019 with additional Regulations and Guidance issued on February 22, 2019.

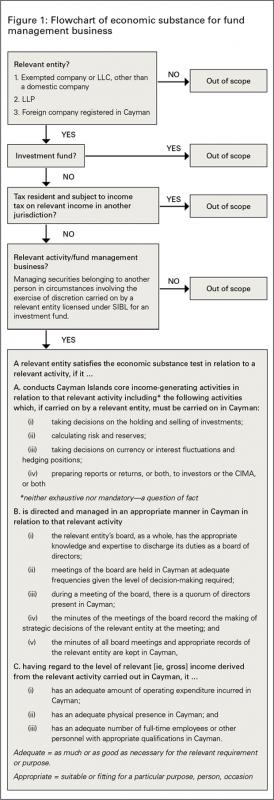

The ES Law requires certain entities incorporated or registered in the Cayman Islands and carrying on specified activities to have “adequate substance” in the Cayman Islands (Figure 1). One of the specified activities, and the focus of this article, is fund management business.

Relevant entities

The ES Law applies to “relevant entities” meaning Cayman companies (other than domestic companies, ie, those carrying on local business), Cayman limited liability companies, Cayman limited liability partnerships and foreign companies registered in Cayman, but excludes investment funds and entities that are tax resident outside the Cayman Islands.

Investment funds are entities whose principal business is the issuing of investment interests to raise funds or pool investor funds with the aim of enabling a holder of such an investment interest to benefit from the profits or gains from the entity’s acquisition, holding, management or disposal of investments and includes any entity through which an investment fund directly or indirectly invests or operates.

Fund management business

“Fund management business” is the business of managing securities belonging to another person in circumstances involving the exercise of discretion, carried on by a relevant entity licensed under the Cayman Islands Securities Investment Business Law (SIBL) for an investment fund.

A relevant entity conducting fund management business is required to satisfy a three-limbed economic substance test in relation to such fund management business. It must:

1. Conduct core income generating activity in the Cayman Islands which includes:

- taking decisions on the holding and selling of investments;

- calculating risk and reserves;

- taking decisions on currency or interest fluctuations and hedging positions; or

- preparing reports or returns, or both, to investors or the Cayman Islands Monetary Authority, or both,

2. Be directed and managed in an appropriate manner in the Cayman Islands which will require, among other things:

- that the board of directors, as a whole, has the appropriate knowledge and expertise to discharge its duties as a board of directors;

- meetings of the board of directors to be held in the Cayman Islands at adequate frequencies given the level of decision-making required;

- the minutes of all meetings of the board of directors and appropriate records of the relevant entity to be kept in the Cayman Islands,

3. Having regard to the level of relevant income derived from the relevant activity carried out in the Cayman Islands:

- have adequate operating expenditure incurred in the Cayman Islands;

- have adequate physical presence (including maintaining a place of business or plant, property and equipment) in the Cayman Islands; and

- have an adequate number of full-time employees or other personnel with appropriate qualifications in the Cayman Islands.

The satisfaction of the economic substance requirements will be a question of fact. There will not be a one-size-fits-all approach and much will depend on the size and nature of the business (in the Cayman Islands and in other locations) in addition to expected gross income in the Cayman Islands.

Cayman Islands service providers are understood to be developing economic substance solutions to assist with the ES Law. It is generally accepted that the core income generating activities to be carried out in the Cayman Islands will, in most cases, involve the engagement of specialist personnel on the ground.

The Cayman Islands’position as a leading centre for financial services with existing infrastructure and highly qualified professional service providers, however, ensures that it is well placed and able to assist with meeting such additional compliance measures.

Possible expansion of scope

The definition of fund management business currently covers only entities that are licensed under SIBL. However, amendments have been proposed to apply economic substance requirements to relevant entities that fall within the definition of, and are registered as, excluded persons under SIBL which are expected to take effect in the not too distant future.

Timing

A relevant entity is required to satisfy the economic substance requirements:

- by July 1, 2019, if in existence before January 1, 2019; or

- on the date on which it commences the relevant activity, if it was not in existence prior to January 1, 2019.

Filings

Starting in 2020 (exact date to be announced), relevant entities will be required to file a notice with the Cayman Islands Tax Information Authority (TIA) stating whether or not they are carrying out relevant activities. Twelve months after the last day of the end of each financial year commencing on or after January 1, 2019, a relevant entity carrying out any relevant activity will be required to file a basic return setting out particulars as to income, expenses, assets, management, employees, physical presence and other matters.

These filings will be examined by the TIA to ensure that the relevant entity has adequate economic substance in the Cayman Islands. If adequate substance is lacking, the TIA will give the entity direction on how to meet the test and may impose a fine of up to $10,000. Continued failure to meet the test in the following year may result in a higher fine of $100,000 and could lead to the entity being struck off the applicable register.

Next steps

All relevant entities conducting fund management business will need to undertake an internal review and analysis to determine what measures, if any, they might need to take in order to achieve compliance.

Economic substance issues will be front and centre for the foreseeable future in Cayman as with other international financial centres that have adopted equivalent legislation.

Listing note

The EU published its updated list of non-cooperative tax jurisdictions on March 12, 2019. The Cayman Islands is listed as a cooperative tax jurisdiction as a result of the timely implementation of the economic substance regime.

Christian Victory is counsel at Appleby (Cayman). He can be contacted at: cvictory@applebyglobal.com